UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

BioSig Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

☐ |

Fee paid previously with preliminary materials. |

|||

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

55 Greens Farms Road

Westport, Connecticut 06880

(203) 409-5444

November 7, 2022

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of BioSig Technologies, Inc. (the “Annual Meeting”) to be held at 10:00 a.m., Eastern Time, on December 20, 2022, at our headquarters located at 55 Greens Farms Road, 1st Floor, Westport, Connecticut 06880.

To facilitate an orderly meeting, we strongly encourage you to advise Lora Mikolaitis by email at info@biosigtech.com or phone at 203-409-5444 ext. 117 if you plan to attend the meeting prior to 5:00 p.m., Eastern Time, on December 19, 2022, and to arrive at the meeting no later than 9:30 a.m., Eastern Time.

We are distributing our proxy materials to certain stockholders via the Internet under the U.S. Securities and Exchange Commission “Notice and Access” rules. We believe this approach allows us to provide stockholders with a timely and convenient way to receive proxy materials and vote, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) beginning on or about November 7, 2022, rather than a paper copy of the Proxy Statement, the proxy card and our 2021 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2021. The Notice of Internet Availability contains instructions on how to access the proxy materials, vote and obtain, if desired, a paper copy of the proxy materials.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present at the Annual Meeting, after receiving the Notice of Internet Availability please vote as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet, by telephone, or by signing, dating and returning the proxy card that is mailed to those that request paper copies of the Proxy Statement and the other proxy materials. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the meeting.

On behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting in person.

Thank you for your support of our company. I look forward to seeing you at the Annual Meeting.

Sincerely,

/s/ Kenneth L. Londoner

Kenneth L. Londoner

Chairman and Chief Executive Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 20, 2022:

Our official Notice of Annual Meeting of Stockholders, Proxy Statement, Form of Proxy Card and

2021 Annual Report to Stockholders are available at:

www.proxyvote.com

BIOSIG TECHNOLOGIES, INC.

55 Greens Farms Road, 1st Floor

Westport, Connecticut 06880

(203) 409-5444

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held December 20, 2022

The 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of BioSig Technologies, Inc., a Delaware corporation (the “Company”), will be held on December 20, 2022, at 10:00 a.m. Eastern Time, at our headquarters at 55 Greens Farms Road, 1st Floor, Westport, Connecticut. We will consider and act on the following items of business at the Annual Meeting:

|

(1) |

Election of seven directors to serve as directors on our Board of Directors (the “Board”) to serve until our 2023 Annual Meeting of Stockholders or until successors have been duly elected and qualified, for which Kenneth L. Londoner, David Weild IV, Patrick J Gallagher, Donald E. Foley, James J. Barry, Frederick D. Hrkac and James L. Klein are the nominees. |

|

|

(2)

|

A proposal to approve an amendment to our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect, at the discretion of the Board but prior to the one-year anniversary of the date on which the reverse stock split is approved by the Company’s stockholders at the Annual Meeting, a reverse stock split of all of the outstanding shares of our common stock, par value $0.001 per share (“Common Stock”), at a ratio in the range of 1-for-2 to 1-for-10, with such ratio to be determined by the Board in its discretion and included in a public announcement (the “Reverse Stock Split Proposal”); |

|

| (3) | A proposal to approve the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan to increase the total number of shares of Common Stock authorized for issuance under such plan by 3,000,000, to a total of 17,474,450 shares. | |

|

(4) |

An advisory vote on the compensation of the Company’s named executive officers as described in the Proxy Statement accompanying this notice. |

|

| (5) | Ratification of the appointment of Marcum LLP (Friedman LLP merged with Marcum LLP effective September 1, 2022) as our independent registered public accounting firm for the 2022 fiscal year. | |

|

(6) |

Such other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

Stockholders are referred to the proxy statement accompanying this notice (the “Proxy Statement”) for more detailed information with respect to the matters to be considered at the Annual Meeting. After careful consideration, the Board of Directors recommends a vote “FOR” the election of the nominees as directors (Proposal 1), “FOR” the approval of the Reverse Stock Split Proposal (Proposal 2), “FOR” the increase in the total number of shares of Common Stock authorized for issuance under the BioSig Technologies, Inc. 2012 Equity Incentive Plan by 3,000,000, to a total of 17,474,450 shares (Proposal 3), “FOR” the approval of the compensation of the Company’s named executive officers (Proposal 4) and “FOR” the ratification of Marcum LLP as our independent registered public accounting firm for the 2022 fiscal year (Proposal 5).

The Board of Directors has fixed the close of business on October 31, 2022, as the record date (the “Record Date”) for the Annual Meeting. Only holders of record of shares of our Common Stock and Series C Preferred Stock on the Record Date are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting or at any postponement(s) or adjournment(s) of the Annual Meeting. A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for inspection at the office of the Company during regular business hours for the ten (10) calendar days prior to the Annual Meeting.

To facilitate an orderly meeting, we strongly encourage you to advise Lora Mikolaitis by email at info@biosigtech.com or phone at 203-409-5444 ext. 117 if you plan to attend the meeting prior to 5:00 p.m., Eastern Time, on December 19, 2022, and to arrive at the meeting no later than 9:30 a.m., Eastern Time.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting in person, we request that you vote by telephone, over the Internet, or complete, date, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy card and in the Proxy Statement to ensure that your shares will be represented at the Annual Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

By Order of the Board of Directors,

/s/ Kenneth L. Londoner

Kenneth L. Londoner

Chairman and Chief Executive Officer

November 7, 2022

|

Page |

|

|

1 |

|

|

7 |

|

|

7 |

|

|

9 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

11 |

|

|

11 |

|

|

14 |

|

|

14 |

|

|

15 |

|

|

15 |

|

|

16 |

|

|

17 |

|

|

19 |

|

|

19 |

|

|

20 |

|

|

20 |

|

|

21 |

|

|

22 |

|

|

23 |

|

|

28 |

|

|

29 |

|

|

29 |

|

|

32 |

|

|

40 |

|

|

40 |

|

|

41 |

|

|

43 |

|

|

46 |

|

|

46 |

|

|

PROPOSAL 4: ADVISORY VOTE ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS |

47 |

| 48 | |

|

49 |

|

|

49 |

|

| Annex A – Reverse Stock Split Amendment to the Amended and Restated Certificate of Incorporation of BioSig Technologies, Inc. | A-1 |

|

Annex B – Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan |

B-1 |

|

C-1 |

|

BIOSIG TECHNOLOGIES, INC.

55 Greens Farms Road, 1st Floor

Westport, Connecticut 06880

(203) 409-5444

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held December 20, 2022

Unless the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” “the Company,” or “BioSig” refer to BioSig Technologies, Inc., a Delaware corporation, and its consolidated subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of our Common Stock, par value $0.001 per share, and our Series C Convertible Preferred Stock (the “Series C Preferred Stock”) entitled to vote at the 2022 annual meeting of stockholders of the Company (the “Annual Meeting”).

The accompanying proxy is solicited by the Board of Directors (the “Board”) on behalf of BioSig Technologies, Inc. to be voted at the Annual Meeting to be held on December 20, 2022, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and at any adjournment(s) or postponement(s) of the Annual Meeting. This Proxy Statement and accompanying form of proxy are dated November 7, 2022 and are expected to be first sent or given to stockholders on or about November 7, 2022.

The executive offices of the Company are located at, and the mailing address of the Company is 55 Greens Farms Road, 1st Floor, Westport, Connecticut 06880.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 20, 2022:

As permitted by the “Notice and Access” rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement, the proxy card and our 2021 Annual Report available to stockholders electronically via the Internet at the following website: www.proxyvote.com.

On or about November 7, 2022, we commenced mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how stockholders may access and review all of the proxy materials and how to vote. Also on or about November 7, 2022, we began mailing printed copies of the proxy materials to stockholders that previously requested printed copies. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

We are using the SEC’s Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials over the Internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about November 7, 2022, we began mailing to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials on the Internet and how to vote online. The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

|

(1) |

Election of seven directors to serve as directors on our Board of Directors to serve until our 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) or until successors have been duly elected and qualified, for which Kenneth L. Londoner, David Weild IV, Patrick J Gallagher, Donald E. Foley, James J. Barry, Frederick D. Hrkac and James L. Klein are the nominees (“Proposal 1”); |

|

|

(2) |

A proposal to approve an amendment to our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect, at the discretion of the Board but prior to the one-year anniversary of the date on which the reverse stock split is approved by the Company’s stockholders at the Annual Meeting, a reverse stock split of all of the outstanding shares of our common stock, par value $0.001 per share (“Common Stock”), at a ratio in the range of 1-for-2 to 1-for-10, with such ratio to be determined by the Board in its discretion and included in a public announcement (“Proposal 2”); |

|

|

(3) |

a proposal to approve the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan to increase the total number of shares of Common Stock authorized for issuance under such plan by 3,000,000, to a total of 17,474,450 shares (“Proposal 3”); |

|

| (4) | an advisory vote on the compensation of the Company’s named executive officers (“Proposal 4”); | |

| (5) | ratification of the appointment of Marcum LLP (Friedman LLP merged with Marcum LLP effective September 1, 2022) as our independent registered public accounting firm for the 2022 fiscal year (“Proposal 5”); and | |

| (6) | such other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

What should I do if I receive more than one set of voting materials?

You may receive more than one Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, this Proxy Statement and the proxy card) or voting instruction card. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, a proxy card) for shares held in your name and a voting instruction card for shares held in “street name.” Please follow the separate voting instructions that you received for your shares of Common Stock held in each of your different accounts to ensure that all of your shares are voted.

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on October 31, 2022 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date, 47,072,868 shares of Common Stock were issued and outstanding. On the Record Date, 105 shares of Series C Preferred Stock were issued and outstanding, and after application of the beneficial ownership limitation pursuant to the terms of the Series C Preferred Stock as set forth in the certificate of designation for the Series C Preferred Stock, certain holders of Series C Preferred Stock are entitled to an aggregate of 408,980 votes on the proposals described in this Proxy Statement. See “What are the voting rights of the stockholders?” below.

Who is entitled to vote at the Annual Meeting?

Holders of Common Stock and the Series C Preferred Stock at the close of business on the Record Date may vote at the Annual Meeting.

What are the voting rights of the stockholders?

The Company has two outstanding classes of voting stock entitled to vote at the Annual Meeting, Common Stock and Series C Preferred Stock. Each holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Annual Meeting. Each holder of Series C Preferred Stock is entitled to the number of votes equal to the number of whole shares of Common Stock into which the shares of Series C Preferred Stock held by such holder are then convertible (subject to the 4.99% beneficial ownership limitations) with respect to any and all matters presented to the stockholders for their action or consideration. Holders of the Series C Preferred Stock vote together with the holders of Common Stock as a single class, except as provided by law and except as set forth in the respective certificates of designation for the Series C Preferred Stock. Holders of our Common Stock and Series C Preferred Stock will vote together as a single class on all matters described in this Proxy Statement.

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of stock entitled to vote at the Annual Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented at the Annual Meeting, then either (i) the chairman of the meeting or (ii) the stockholders entitled to vote thereat, present in person or represented by proxy, may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present or represented.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Action Stock Transfer Corporation, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The Notice of Internet Availability has been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of Internet Availability has been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New York Stock Exchange (the “NYSE”) that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Neither Proposal 1 or Proposal 3 is considered a “routine matter.” In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposals 1 or 3. Proposal 2, Proposal 4, and Proposal 5 are considered “routine” matters. Therefore, if you do not provide voting instructions to your broker regarding such proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on such proposal.

How do I vote my shares?

If you are a record holder, you may vote your shares at the Annual Meeting in person or by proxy. To vote in person, you must attend the Annual Meeting and obtain and submit a ballot. The ballot will be provided at the Annual Meeting. To vote by proxy, you may choose one of the following methods to vote your shares:

|

• |

Via Internet: as prompted by the menu found at www.proxyvote.com, follow the instructions to obtain your records and submit an electronic ballot. Please have your Stockholder Control Number, which can be found on the bottom of the Notice of Internet Availability, when you access this voting site. You may vote via the Internet until 11:59 p.m., Eastern Time, on December 19, 2022. |

|

• |

Via telephone: call 1-800-690-6903 and then follow the voice instructions. Please have your Stockholder Control Number, which can be found on the bottom of the Notice of Internet Availability, when you call. You may vote by telephone until 11:59 p.m., Eastern Time, on December 19, 2022. |

|

• |

Via mail: if you requested printed proxy materials as provided in the Notice of Internet Availability and would like to vote by mail, complete and sign the accompanying proxy card and return it in the postage-paid envelope provided. If you submit a signed proxy without indicating your vote, the person voting the proxy will vote your shares according to the Board’s recommendation. |

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting it, you will direct the designated persons (known as “proxies”) to vote your stock at the Annual Meeting in accordance with your instructions. The Board has appointed Kenneth L. Londoner and Steve Chaussy to serve as the proxies for the Annual Meeting.

Your proxy will be valid only if you complete and return it before the Annual Meeting. If you properly complete and transmit your proxy but do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR” each proposal as to which you provide no voting instructions in accordance with the Board’s recommendation in the manner described under “What if I do not specify how I want my shares voted?” below. We do not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What is a broker non-vote?” Alternatively, if you want to vote your shares in person at the Annual Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy. If you fail to bring a nominee-issued proxy to the Annual Meeting, you will not be able to vote your nominee-held shares in person at the Annual Meeting.

Who counts the votes?

All votes will be tabulated by Kenneth L. Londoner, the inspector of election appointed for the Annual Meeting. Each proposal will be tabulated separately.

Can I vote my shares in person at the Annual Meeting?

Yes. If you are a stockholder of record, you may vote your shares at the meeting by completing a ballot at the Annual Meeting.

If you hold your shares in “street name,” you may vote your shares in person only if you obtain a proxy issued by your bank, broker or other nominee giving you the right to vote the shares.

Even if you currently plan to attend the Annual Meeting, we recommend that you also return your proxy or voting instructions as described above so that your votes will be counted if you later decide not to attend the Annual Meeting or are unable to attend.

What are my choices when voting?

In the election of the nominees as directors (Proposal 1), stockholders may vote for the director nominees or may withhold their votes as to one or more director nominees. With respect to the approval of the Reverse Stock Split Proposal (Proposal 2), Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan (Proposal 3), the advisory vote on executive compensation (Proposal 4) and the ratification of the independent registered public accounting firm (Proposal 5), stockholders may vote for the proposal, against the proposal, or abstain from voting on the proposal.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

Proposal 1—FOR the election of the nominees as directors.

Proposal 2—FOR the approval of a Reverse Stock Split Proposal.

Proposal 3—FOR the approval of the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan.

Proposal 4—FOR the approval of the executive compensation, as described in the Proxy Statement.

Proposal 5—FOR the ratification of the appointment of the independent registered public accounting firm.

What if I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals, the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

Proposal 1—FOR the election of the nominees as directors.

Proposal 2—FOR the approval of a Reverse Stock Split Proposal.

Proposal 3—FOR the approval of the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan.

Proposal 4—FOR the approval of the executive compensation, as described in the Proxy Statement.

Proposal 5—FOR the ratification of the appointment of the independent registered public accounting firm.

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee may be unable to vote those shares. See “What is a broker non-vote?” above.

Can I change my vote?

Yes. If you are a record holder, you may revoke your proxy at any time by any of the following means:

|

• |

Attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting will not by itself revoke a proxy. You must vote your shares by ballot at the Annual Meeting to revoke your proxy. |

|

• |

Completing and submitting a new valid proxy bearing a later date. |

|

• |

Giving written notice of revocation to the Company addressed to Steve Chaussy, Chief Financial Officer, at the Company’s address above, which notice must be received before 5:00 p.m., Eastern Time, on December 19, 2022. |

If you are a “street name” holder, your bank, broker or other nominee should provide instructions explaining how you may change or revoke your voting instructions.

What votes are required to approve each proposal?

Assuming the presence of a quorum, with respect to Proposal 1, the affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election of the director nominees, i.e., the seven director nominees who receive the most votes will be elected.

Assuming the presence of a quorum, approval of Proposal 2 will require the affirmative vote of a majority of the outstanding shares entitled to vote for the proposal.

Assuming the presence of a quorum, the approval of the 10th amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan (Proposal 3), the approval of the executive compensation (Proposal 4), and the ratification of the independent registered public accounting firm (Proposal 5) will require the affirmative vote of the holders of a majority of the shares of our voting securities represented in person or by proxy at the Annual Meeting entitled to vote on such proposal that voted for or against such proposal.

How are abstentions and broker non-votes treated?

Abstentions are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting. Abstentions will have no effect with respect to the election of the nominees as directors (Proposal 1), the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan (Proposal 3), the advisory vote on executive compensation (Proposal 4), or the ratification of the independent registered public accounting firm (Proposal 5). Abstentions will have the same effect as a vote against the proposal to approve the Reverse Split (Proposal 2).

Broker non-votes are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting. Broker non-votes will have no effect upon the election of the nominees as directors (Proposal 1), the approval of the Tenth Amendment to the BioSig Technologies, Inc. 2012 Equity Incentive Plan (Proposal 3) and the advisory vote on executive compensation (Proposal 4) because broker non-votes are not considered shares entitled to vote. With respect to the Reverse Stock Split Proposal (Proposal 2), the proposal to ratify the appointment of the independent registered public accounting firm (Proposal 5), and the adjournment proposal, broker-non-votes are not applicable because such proposal is considered a routine matter and therefore a broker holding shares for a beneficial owner will have discretionary authority to vote those shares for such proposal in the absence of voting instructions from the beneficial owner.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

Our Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Common Stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies, as described below.

Is this Proxy Statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the Notice of Internet Availability, officers and employees of the Company may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees and fiduciaries, in connection with shares of the Common Stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of Common Stock.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find voting results?

We expect to publish the voting results in a current report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have any questions, or need additional materials, please feel free to contact our Chief Financial Officer, Steve Chaussy, at (203) 409-5444 ext. 102.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board currently is comprised of seven directors. The Board believes seven is an appropriate size for a company with its market capitalization.

Our Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following seven individuals to serve as directors (collectively, the “Company Nominees”):

|

Name |

Age |

|

|

Kenneth L. Londoner |

55 |

|

|

David Weild IV |

65 |

|

|

Patrick J. Gallagher |

57 |

|

|

Donald E. Foley |

71 |

|

|

James J. Barry, PhD |

63 |

|

|

Frederick D. Hrkac |

57 |

|

|

James L. Klein |

58 |

If elected, respectively, the Company Nominees will serve until our 2023 Annual Meeting or until successors have been duly elected and qualified. Our Board believes that all of our current directors, including the seven nominees for election, possess personal and professional integrity, good judgment, a high level of ability and business acumen.

The biographies of the Company Nominees are as follows:

Kenneth L. Londoner. Mr. Londoner has served as our director since February 2009, as our executive chairman since November 2013 and our chief executive officer since July 2017. He previously served as our chairman and chief executive officer from February 2009 to September 2013. Mr. Londoner served as the chief executive officer and president of ViralClear Pharmaceuticals, Inc., a majority-owned subsidiary of the Company (“ViralClear”) from November 2018 through April 2020 and again since October 2020; and served as ViralClear’s chairman of the board of directors from July 2019 through April 2020 and again since October 2020. Mr. Londoner has been serving as ViralClear’s director since November 2018. Mr. Londoner has served as the managing partner of Endicott Management Partners, LLC, a firm dedicated to assisting emerging growth companies in their corporate development since February 2010. From April 2007 to October 2009, he served as executive vice president – corporate business development and senior director of business development and, from November 2009 to December 2010, he served as a consultant to NewCardio, Inc., a medical device designer and developer. Mr. Londoner also served as a director of chatAND Inc. from January 2012 to April 2015. Mr. Londoner is a co-founder and board member of Safe Ports Holdings, Charleston, South Carolina. Mr. Londoner also served as a director of MedClean Technologies, Inc. from November 2008 to September 2010. Mr. Londoner was an investment officer and co-manager of the Seligman Growth Fund, Seligman Capital Fund, and approximately $2 billion of pension assets at J & W Seligman & Co, Inc. in New York from 1991 to 1997. Mr. Londoner graduated from Lafayette College in 1989 with a degree in economics and finance and received his MBA from New York University’s Leonard N. Stern School of Business in 1994.We believe that Mr. Londoner’s extensive experience in financial and venture capital matters, as well as his intimate knowledge of our company as its co-founder make him an asset to our Board.

David Weild IV. Mr. Weild has served as a director since May 2015. Mr. Weild is founder, chairman and chief executive officer of Weild & Co., Inc., an Inc. 5000 Company and parent company of the investment banking firm Weild Capital, LLC. Prior to Weild & Co., Mr. Weild was vice chairman of NASDAQ, president of PrudentialFinancial.com and head of corporate finance and equity capital markets at Prudential Securities, Inc. Mr. Weild holds an M.B.A. from the Stern School of Business and a B.A. from Wesleyan University. Mr. Weild is currently on the board of Scopus BioPharma and INX, LTD and previously served on the board of PAVmed. From September 2010 to June 2011, Mr. Weild served on the board of Helium.com, until it was acquired by R.R. Donnelly & Sons Co. Since 2003, Mr. Weild was a director and then chairman of the board of the 9-11 charity Tuesday’s Children. He became chairman emeritus in late 2016 and still serves on its board. Mr. Weild brings extensive financial, economic, stock exchange, capital markets, and small company expertise to our Board gained throughout his career on Wall Street. He is a recognized expert in capital markets and has spoken at the White House, Congress, the SEC, Organisation for Economic Co-operation and Development and the G-20 on how market structure can be bettered to improve capital formation and economic growth.

Patrick J. Gallagher. Mr. Gallagher has served as our director since July 2014. Mr. Gallagher, MBA, CFA, is an accomplished capital markets executive, advisor, and investor with a distinguished record of success in both the public and private markets. He has nearly 20 years of experience on Wall Street and extensive expertise in alternative investments, capital markets, and marketing. Since September 2014, Mr. Gallagher has served as senior managing director and head of healthcare sales at Laidlaw & Co. (UK) Ltd. Mr. Gallagher serves as a strategic consultant for Athenex, Inc., a biopharmaceutical firm focused on next-generation therapies in oncology and immunology and was the vice president of business development and investor relations from September 2012 to October 2013. He also sits on the board of directors of Cingulate Therapeutics since July 2013, a clinical stage biopharmaceutical company focused on innovative new products for ADHD, as well as Evermore Global Advisors, a global money manager since May 2015. In November 2010, he was appointed by broker Concept Capital, a division of Sanders Morris Harris, as a managing director and the head of institutional sales. In 2001, Mr. Gallagher co-founded BDR Research Group, LLC, an independent sell-side research firm specializing in healthcare investing, financing and operations, and served as its chief executive officer until November 2010. Prior to 2001, he held various sales positions at investment and research firms Kidder Peabody, PaineWebber and New Vernon Associates. Mr. Gallagher is a CFA charter holder, received his MBA from Pennsylvania State University and holds a B.S. degree in finance from the University of Vermont. We believe that Mr. Gallagher’s experience in capital markets and marketing, with extensive expertise concentrated in the life sciences space, make him a valuable resource on our Board.

Donald E. Foley. Mr. Foley has served as a director since October 2015. Mr. Foley was Chairman of the Board and Chief Executive Officer of the Wilmington Trust Corporation from 2010-2011. Prior to Wilmington Trust Corporation, Mr. Foley was Senior Vice President, Treasurer, and Director of Tax for ITT Corporation, a supplier of advanced technology products and services. Prior experiences include executive positions with International Paper Corporation, Mobil Corporation and General Electric Company. Mr. Foley currently serves on the Boards of Directors of Equitable EQAT Funds and Wilmington Trust Mutual Fund complexes. Mr. Foley has served on the Boards of Directors of M&T Corporation from 2011-2012, of Wilmington Trust Company and Wilmington Trust Corporation from 2007-2011, and several other publicly-listed and privately-owned companies. In addition, between 2005 and 2018, Mr. Foley served as Chairman of the Board of Trustees of the Burke Rehabilitation Hospital during which time the Hospital merged with the Montefiore Hospital System and, since 2009, Chair of the Winifred Masterson Burke Foundation and Trustee of the Burke Medical Research Institute. Mr. Foley has served as an advisory board member of M&T Corporation’s Trust and Investment Committee, the Goldman Sachs’ and Northern Trust Company’s Asset Management Groups. Mr. Foley holds an M.B.A. from New York University and a B.A. from Union College where he served as a Trustee and Chairman of the President’s Council. He has also served as a Trustee of the Convent of the Sacred Heart and currently serves as Trustee at the Sacred Heart Network of Schools. He is the Chairman of the Board of the New Beginnings Family Academy, a charter school in Bridgeport, Connecticut. Mr. Foley has extensive financial, economic, capital markets and executive leadership expertise for the BioSig Board gained through his successful career on Wall Street and the Fortune 500.

James J Barry, Ph.D. Dr. Barry has served as our director since September 2021. Dr. Barry has more than 30 years of experience in the medical device industry as an executive and corporate board director. He is currently the Principal Owner at Convergent Biomedical Group LLC since January 2011, a company providing advisory services to the life sciences industry. Prior to Convergent, Dr. Barry was President and CEO at InspireMD, Inc. (Nasdaq: NSPR) from June 2016 to December 2019 and platform technology company, Arsenal Medical from August 2011 to December 2013. Dr. Barry spent the majority of his career at Boston Scientific (NYSE: BSX) from April 1992 to June 2010 with increasing roles of responsibility culminating as Sr. Vice President of Corporate Technology. While at Boston Scientific, Dr. Barry led the development and launch of the TAXUS drug-eluting coronary stent that achieved annual sales exceeding $3 billion. Dr. Barry is the author of multiple peer-reviewed publications and holds more than 40 U.S. and international patents. He holds a Ph.D. in Biochemistry from the University of Massachusetts-Lowell and a B.A. in Chemistry from St. Anselm College. Dr. Barry brings extensive leadership, sales and patent expertise, making him a valuable resource on our Board.

Frederick D. Hrkac. Mr. Hrkac has served as our director since April 2022. Mr. Hrkac has more than 30 years of experience in the medical device industry as an executive and corporate board director. He is currently serves on the board of Serres in Helsinki, Finland since September 2018, and Spineart in Geneva, Switzerland as chairman of the board since August 2017. In 2017, he served as senior vice president corporate development and from 2014-2016 served a senior vice president of global commercial operations of Biosensors International. From 2009-2011, Mr. Hrkac served as Europe, Middle East & Africa president of Boston Scientific where he was responsible for $1.8 billion of sales. From 2005-2009, Mr. Hrkac was an executive of Sorin Group CRM, Paris, France. And, from November 1990-April 2005 he lived in 6 different countries working as an executive of Biosense Webster, a Johnson & Johnson company having laid the groundwork strategically for the most successful J&J division of last 15 years with sales of over $5b in 2021. Mr. Hrkac is a university lecturer at the Kelley School of Business-University of Indiana and at Oxford University, Oxford England teaching strategic planning, and talent and cross-cultural management and development. Mr. Hrkac holds a honours bachelor of business administration from the Wilfrid Laurier University, Waterloo, Ontario Canada. Mr. Hrkac brings extensive expertise in global marketing and strategic business development, making him a valuable resource for our Board.

James L. Klein. Mr. Klein has served as our director since May 2022. Mr. Klein is an accomplished technology executive and business leader with over 30 years of experience in the RF electronics market. He is experienced in leading high-growth diversified businesses with international footprints. From January 2015 to January 2021, Mr. Klein served as President of Qorvo (previously TriQuint). During his tenure at Qorvo, Mr. Klein was responsible for Qorvo’s Infrastructure and Defense Products (IDP) business unit. Under his leadership, the segment reported approximately $1.2 billion in annual revenue. From January 1997 to July 2011, Mr. Klein was employed by Raytheon and served as the General Manager of Advanced Products Center. He is currently on an Advisory Board at Qorvo Biotechnologies and the on the Electrical and Computer Engineering External Advisory Council at Texas A&M University. Mr. Klein holds a BS & MS in Electrical Engineering from Texas A&M University. As a proven leader with expertise in strategic growth, technology development and board governance, Mr. Klein is an invaluable asset to our Board.

There are no family relationships amongst our directors and executive officers.

Required Vote and Board Recommendation

If a quorum is present, the Company Nominees will be elected by a plurality of the votes cast at the Annual Meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the vote.. The seven Company Nominees receiving the highest number of affirmative votes will be elected directors of the Company. Shares of voting stock represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named below. Should any Company Nominee become unable or unwilling to accept nomination or election, the proxy holders may vote the proxies for the election, in his or her stead, of any other person the Board may nominate or designate. Each Company Nominee has agreed to serve, if elected, and the Board has no reason to believe that any Company Nominee will be unable to serve.

|

The Board recommends that you vote “FOR” each Company Nominee. |

BioSig, with the oversight of the Board and its committees, operates within a comprehensive plan of corporate governance for the purpose of defining independence, assigning responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our officers, directors and employees, including our principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics addresses, among other things, conflicts of interest, protection and proper use of Company assets, government relations, compliance with laws, rules and regulations and the process for reporting violations of the Code of Business Conduct and Ethics, improper conflicts of interest or other violations. Our Code of Business Conduct and Ethics is available on our website at www.biosigtech.com in the “Governance Documents” section found under the “Investors” tab. We intend to disclose any future amendments to certain provisions of the Code of Business Conduct and Ethics, or waivers of such provisions granted to executive officers and directors, on this website within four business days following the date of any such amendment or waiver.

Policy on Trading, Pledging and Hedging of Company Stock

We maintain an insider trading policy that, among other things, prohibits all officers, including our named executive officers, directors and employees from engaging in “hedging” transactions with respect to our securities. This includes short sales, hedging of share ownership positions, transactions in straddles, collars or other similar risk reduction or hedging devices, and transactions involving derivative securities relating to our Common Stock. In addition, they are also prohibited from pledging the Company’s securities.

Our Amended and Restated Certificate of Incorporation, as amended, and our Amended and Restated Bylaws, as amended (“Bylaws”), provide that our Board will consist of one or more members, such number of directors to be determined from time to time pursuant to a resolution adopted by a majority of the total number of authorized directors. Vacancies or newly created directorships resulting from an increase in the authorized number of directors elected by all of the stockholders having the right to vote as a single class may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

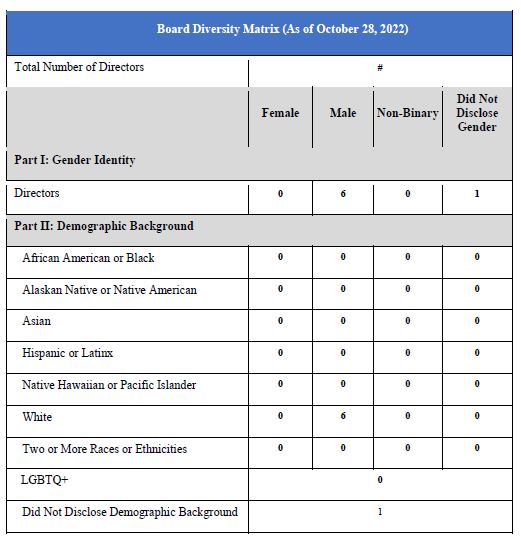

Board Diversity and Board Diversity Matrix

We have no formal policy regarding Board diversity. Our Board believes that each director should have a basic understanding of our principal operational and financial objectives and plans and strategies, our results of operations and financial condition and relative standing in relation to our competitors. We take into consideration the overall composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience, knowledge, abilities and customer relationships. Generally, we will strive to assemble a Board that brings to us a variety of perspectives and skills derived from business and professional experience as we may deem are in our and our stockholders’ best interests. In doing so, we will also consider candidates with appropriate non-business backgrounds.

Nasdaq’s Board Diversity Rule, which was approved by the SEC on August 6, 2021, is a disclosure standard designed to encourage a minimum board diversity objective for companies and provide stakeholders with consistent, comparable disclosures concerning a company’s current board composition. This rule requires companies listed on the Nasdaq exchange to: (1) publicly disclose board-level diversity statistics using a standardized template; and (2) have or explain why they do not have at least two diverse directors. In alignment with the Diversity Objective described in section 5605(f) of the NASDAQ rule, as a Smaller Reporting Company (as defined in Rule 12b-2 under the Exchange Act), we set an objective to have at least two members of the Board who self-identify as diverse (as defined in section 5605(f)(1) of the NASDAQ rule), including at least one diverse director who self-identified as female. As per the NASDAQ rule, the second director may include an individual who self-identifies as one or more of the following: female, LGBTQ+, or an underrepresented minority.

Our current board composition is reflected in the following matrix:

We are currently listed on the NASDAQ Capital Market and therefore rely on the definition of independence set forth in the NASDAQ Listing Rules (“NASDAQ Rules”). Under the NASDAQ Rules, a director will only qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based upon information requested from and provided by each director concerning his background, employment, and affiliations, including family relationships, we have determined that each of David Weild IV, Patrick J. Gallagher, Donald E. Foley, Frederick D. Hrkac, James L. Klein and James J. Barry has no material relationships with us that would interfere with the exercise of independent judgment and is an “independent director” as that term is defined in the NASDAQ Listing Rules.

Board Committees, Meetings and Attendance

During 2021, the Board held four meetings. We expect our directors to attend Board meetings, meetings of any committees and subcommittees on which they serve and each annual meeting of stockholders, either in person or teleconference. During 2021, we had no incumbent director who attended fewer than 75% of the total number of meetings held by the Board and Board committees of which such director was a member. Due to the pandemic, none of the seven directors attended our 2021 annual meeting of stockholders.

The Board delegates various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions to the full Board. Currently, the Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Committee assignments are re-evaluated annually. Each of these committees operates under a charter that has been approved by our Board.

As of October 31, 2022, the following table sets forth the membership of each of the Board committees listed above.

|

Name |

Audit Committee |

Compensation Committee |

Nominating and |

|||

|

Kenneth L. Londoner* |

||||||

|

David Weild IV |

Chairman |

Member |

||||

|

Patrick J. Gallagher |

Member |

Member |

||||

|

Donald E. Foley |

Chairman |

Member |

||||

|

James J. Barry PhD |

Member |

|||||

|

Frederick D. Hrkac |

Chairman |

|||||

|

James L. Klein |

Member |

|

* |

Chairman of the Board of Directors |

Audit Committee

Our Audit Committee is responsible for, among other matters:

|

• |

approving and retaining the independent auditors to conduct the annual audit of our financial statements; |

|

• |

reviewing the proposed scope and results of the audit; |

|

• |

reviewing and pre-approving audit and non-audit fees and services; |

|

• |

reviewing accounting and financial controls with the independent auditors and our financial and accounting staff; |

|

• |

reviewing and approving transactions between us and our directors, officers and affiliates; |

|

• |

recognizing and preventing prohibited non-audit services; |

|

• |

establishing procedures for complaints received by us regarding accounting matters; |

|

• |

overseeing internal audit functions, if any; and |

|

• |

preparing the report of the audit committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our Audit Committee is composed of Messrs. Weild, Gallagher and Klein, each of whom our board has determined to be financially literate and qualifies as an independent director under Section 5605(a)(2) and Section 5605(c)(2)(A) of the rules of the NASDAQ Stock Market. Further, each member of our Audit Committee is also considered independent under SEC Rule 10A-3. Mr. Weild is the chairman of our audit committee. In addition, Mr. Weild qualifies as a financial expert, as defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee met four times during 2021. Our Audit Committee’s charter is available on our website at www.biosigtech.com in the “Governance Documents” section found under the “Investors” tab.

Compensation Committee

Our Compensation Committee is responsible for, among other matters:

|

• |

reviewing and recommending the compensation arrangements for management, including the compensation for our president and chief executive officer; |

|

• |

appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other advisor retained by the Compensation Committee; |

|

• |

establishing and reviewing general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; |

|

• |

administering our stock incentive plans; and |

|

• |

preparing the report of the compensation committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our Compensation Committee is composed of Messrs. Foley, Gallagher and Barry, each of whom qualifies as an independent director under Section 5605(a)(2) of the rules of the NASDAQ Stock Market, an “outside director” for purposes of Section 162(m) of the Internal Revenue Code and a “non-employee director” for purposes of Section 16b-3 under the Securities Exchange Act of 1934, as amended, and does not have a relationship to us which is material to his ability to be independent from management in connection with the duties of a compensation committee member, as described in Section 5605(d)(2) of the rules of the NASDAQ Stock Market. Mr. Foley is the chairman of our compensation committee. The Compensation Committee met four times during 2021. We did not engage any consultants in determining or recommending the amount or form of executive and director compensation during 2021. Our Compensation Committee’s charter is available on our website at www.biosigtech.com in the “Governance Documents” section found under the “Investors” tab.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other matters:

|

● |

evaluating the current composition, organization and governance of the Board and its committees, and making recommendations for changes thereto; |

|

● |

reviewing each director and nominee annually; |

|

● |

determining desired Board member skills and attributes and conducting searches for prospective members accordingly; |

|

● |

evaluating nominees, and making recommendations to the Board concerning the appointment of directors to Board committees, the selection of Board committee chairs, proposal of the slate of directors for election to the Board, and the termination of membership of individual directors in accordance with the Board’s governance principles; |

|

● |

overseeing the process of succession planning for the chief executive officer and, as warranted, other senior officers of the Company; |

|

● |

developing, adopting and overseeing the implementation of a code of business conduct and ethics; and |

|

● |

administering the annual Board performance evaluation process. |

Our Nominating and Corporate Governance Committee is composed of Messrs. Hrkac, Foley and Weild, each of whom qualifies as an independent director under Section 5605(a)(2) of the rules of the NASDAQ Stock Market. Mr. Hrkac is the chairman of our nominating and corporate governance committee. The Nominating and Corporate Governance Committee met two times during 2021. Our Nominating and Corporate Governance Committee’s charter is available on our website at www.biosigtech.com in the “Governance Documents” section found under the “Investors” tab.

Our Nominating and Corporate Governance Committee considers all qualified candidates identified by members of the Board, by senior management and by stockholders. The Nominating and Corporate Governance Committee follows the same process and uses the same criteria for evaluating candidates proposed by stockholders, members of the Board and members of senior management. We did not pay fees to any third party to assist in the process of identifying or evaluating director candidates during 2021.

Our Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at our annual meetings of stockholders. To recommend a nominee for election to the Board, a stockholder must submit his or her recommendation to our Secretary at our corporate offices at 55 Greens Farms Road, 1st Floor, Westport, Connecticut 06880. Such nomination must satisfy the notice, information and consent requirements set forth in our Bylaws and must be received by us prior to the date set forth under “Submission of Future Stockholder Proposals” below. A stockholder’s recommendation must be accompanied by the information with respect to stockholder nominees as specified in our Bylaws, including among other things, the name, age, address and occupation of the recommended person, the proposing stockholder’s name and address, the ownership interests of the proposing stockholder and any beneficial owner on whose behalf the nomination is being made (including the number of shares beneficially owned, any hedging, derivative, short or other economic interests and any rights to vote any shares) and any material monetary or other relationships between the recommended person and the proposing stockholder and/or the beneficial owners, if any, on whose behalf the nomination is being made.

In evaluating director nominees, the Nominating and Corporate Governance Committee considers the following factors:

|

● |

the appropriate size and diversity of our Board; |

|

● |

our needs with respect to the particular knowledge, skills and experience of nominees, including experience in corporate finance, technology, business, administration and sales, in light of the prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

|

● |

experience with accounting rules and practices, and whether such a person qualifies as an “audit committee financial expert” pursuant to SEC rules; and |

|

● |

balancing continuity of our Board with periodic injection of fresh perspectives provided by new Board members. |

Our Board believes that each director should have a basic understanding of our principal operational and financial objectives and plans and strategies, our results of operations and financial condition and our relative standing in relation to our competitors.

In identifying director nominees, the Board will first evaluate the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service will be considered for re-nomination.

If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Board will identify another nominee with the desired skills and experience described above. The Board takes into consideration the overall composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience, knowledge, abilities and customer relationships. Generally, the Board will strive to assemble a Board that brings to us a variety of perspectives and skills derived from business and professional experience as it may deem are in our and our stockholders’ best interests. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

Board Leadership Structure and Role in Risk Oversight

The Board is committed to promoting effective, independent governance of the Company. Our Board believes it is in the best interests of the stockholders and the Company for the Board to have the flexibility to select the best director to serve as chairman at any given time, regardless of whether that director is an independent director or the chief executive officer. Consequently, we do not have a policy governing whether the roles of chairman of the board and chief executive officer should be separate or combined. This decision is made by our board of directors, based on the best interests of the Company considering the circumstances at the time.

Currently, the positions of Chairman of the Board and principal executive officer are filled by one individual, Kenneth L. Londoner, coupled with a lead independent director position to further strengthen the leadership structure. The Board acknowledges that there are different leadership structures that could allow it to effectively oversee the management of the risks relating to the Company’s operations and believes its current leadership structure enables it to effectively provide oversight with respect to such risks. However, our Board believes the current structure provides an efficient and effective leadership model for the Company and that combining the Chairman of the Board and principal executive officer roles fosters clear accountability, effective decision-making and alignment on corporate strategy.

Moreover, the Board believes that its governance practices provide adequate safeguards against any potential risks that might be associated with having a combined Chairman and principal executive officer.

Specifically:

|

● |

Six of the seven current directors of the Company (six of the seven Company Nominees) are independent directors; |

|

● |

All of the members of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee are independent directors; |

|

● |

The Board and its committees regularly conduct scheduled meetings in executive session, out of the presence of Mr. Londoner and other members of management; and |

|

● |

The Board and its committees remain in close contact with, and receive reports on, various aspects of the Company’s management and enterprise risk directly from, the Company’s senior management and independent auditors. |

Our Audit Committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full Board. The Audit Committee receives reports from management concerning the Company’s assessment of risks. In addition, the Audit Committee reports regularly to the full Board, which also considers the Company’s risk profile. The Audit Committee and the full Board focus on the most significant risks facing the Company and the Company’s general risk management strategy. In addition, as part of its oversight of our Company’s executive compensation program, the Compensation Committee considers the impact of such program, and the incentives created by the compensation awards that it administers, on our Company’s risk profile. In addition, the Compensation Committee reviews all of our compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to our Company. The Compensation Committee has determined that, for all employees, our compensation programs do not encourage excessive risk and instead encourage behaviors that support sustainable value creation.

The Board welcomes communication from our stockholders. Stockholders and other interested parties who wish to communicate with a member or members of our Board or a committee thereof may do so by addressing correspondence to the Board member, members or committee, c/o Secretary, BioSig Technologies, Inc., 55 Greens Farms Road, 1st Floor, Westport, Connecticut 06880. Our Secretary will review and forward correspondence to the appropriate person or persons.

All communications received as set forth in the preceding paragraph will be opened by our Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee(s). In the case of communications to the Board or any group or committee of directors, our Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to whom the communication is addressed. If the amount of correspondence received through the foregoing process becomes excessive, our Board may consider approving a process for review, organization and screening of the correspondence by our Secretary or another appropriate person.

Involvement in Certain Legal Proceedings

There have been no material legal proceedings that would require disclosure under the federal securities laws that are material to an evaluation of the ability or integrity of our directors or executive officers, or in which any director, officer, nominee or principal stockholder, or any affiliate thereof, is a party adverse to us or has a material interest adverse to us.

The following table presents the total compensation for each person who served as a non-employee director of our Board during the fiscal year ended December 31, 2021. Other than as set forth in the table and described more fully below, we did not pay any compensation, reimburse any expense of, make any equity awards or non-equity awards to, or pay any other compensation to any of the other members of our Board in such period.

Director Compensation Table

2021

|

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (1) |

Option Awards ($) (1) |

All Other Compensation ($) (1)(2) |

Total ($) |

|||||||||||||||||

|

Donald E. Foley |

$ | 65,000 | $ | - | (2 |

) |

$ | 119,633 | (3 |

) |

$ | 184,633 | ||||||||||

|

Andrew L. Filler * |

$ | 20,000 | $ | - | $ | - | $ | 20,000 | ||||||||||||||

|

Patrick J Gallagher |

$ | 60,000 | $ | - | (4 |

) |

$ | 79,756 | (5 |

) |

$ | 139,756 | ||||||||||

|

Jeffrey F O’Donnell, Sr# |

$ | 80,000 | $ | 67,957 | $ | - | $ | 80,000 | ||||||||||||||

|

David Weild, IV |

$ | 80,000 | $ | - | (6 |

) |

$ | 119,633 | (7 |

) |

$ | 199,633 | ||||||||||

|

Samuel E. Navarro |

$ | 60,000 | $ | - | (8 |

) |

$ | 79,756 | (9 |

) |

$ | 139,756 | ||||||||||

|

Martha Pease* |

$ | 15,000 | $ | - | $ | - | $ | 15,000 | ||||||||||||||

|

James J. Barry PhD^ |

$ | 15,000 | $ | - | (10 |

) |

$ | 166,907 | (11 |

) |

$ | 181,907 | ||||||||||

|

Anthony Zook |

$ | 60,000 | $ | - | (12 |

) |

$ | 79,756 | (13 |

) |

$ | 139,756 | ||||||||||

| $ | ||||||||||||||||||||||

|

Total: |

$ | 455,000 | $ | - | $ | 645,441 | - | $ | 1,100,441 | |||||||||||||

|

(1) |

In accordance with SEC rules, this column reflects the aggregate fair value of stock or option awards granted during the fiscal year ended December 31, 2021, computed as of their respective grant dates in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718 for share-based compensation transactions. |

|

(2) |

As of December 31, 2021, Mr. Foley had no outstanding stock awards of shares of Common Stock. |

|

(3) |

Represents a stock option granted December 28, 2021 for the purchase of 75,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 share and termination date of December 28, 2031. As of December 31, 2021, Mr. Foley had outstanding options representing the right to purchase of 274,000 shares of Common Stock. |

|

(4) |

As of December 31, 2021, Mr. Gallagher had no outstanding stock awards of shares of Common Stock. |

|

(5) |

Represents a stock option granted December 28, 2021 for the purchase of 50,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 per share and termination date of December 28, 2031. As of December 31, 2021, Mr. Gallagher had outstanding options representing the right to purchase of 186,240 shares of Common Stock. |

|

(6) |

As of December 31, 2021, Mr. Weild had no outstanding stock awards of shares of Common Stock. |

|

(7) |

Represents a stock option granted December 28, 2021 for the purchase of 75,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 per share and termination date of December 28, 2031. As of December 31, 2021, Mr. Weild had outstanding options representing the right to purchase of 395,372 shares of Common Stock. |

|

(8) |

As of December 31, 2021, Mr. Navarro had no outstanding stock awards of shares of Common Stock. |

|

(9) |

Represents a stock option granted December 28, 2021 for the purchase of 50,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 per share and termination date of December 28, 2031. As of December 31, 2021, stock. As of December 31, 2021, Mr. Navarro had (i) outstanding options representing the right to purchase of 129,000 shares of Common Stock and (ii) outstanding 329,000 restricted stock units representing rights to shares of ViralClear common stock. |

|

(10) |

As of December 31, 2021, Dr. Barry had no outstanding stock awards of shares of Common Stock. |

|

(11) |

Represents (i) a stock option granted October 4, 2021 for the purchase of 50,000 shares of Common Stock, 50% vesting immediately and 50% vesting September 20, 2022 at an exercise price of $2.89 per share and termination date of October 4, 2031 and (ii) a stock option granted December 28, 2021 for the purchase of 50,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 per share and termination date of December 28, 2031. As of December 31, 2021, Mr. Barry had outstanding options representing the right to purchase of 100,000 shares of Common Stock. |

|

(12) |

As of December 31, 2021, Mr. Zook had no outstanding stock awards of shares of Common Stock. |

|

(13) |

Represents a stock option granted December 28, 2021 for the purchase of 50,000 shares of Common Stock, vesting immediately at an exercise price of $2.44 per share and termination date of December 28, 2031. As of December 31, 2021, stock. As of December 31, 2021, Mr. Zook had (i) outstanding options representing the right to purchase of 50,000 shares of Common Stockand (ii) outstanding ViralClear options representing the right to purchase 100,000 shares of ViralClear common stock. |

* Effective as of June 28, 2021, Mr. Filler and Ms. Pease retired as a director of the Company.

# Mr. O’Donnell resigned from the Board on June 30, 2021.

^ Mr. Barry was appointed to the Board on September 20, 2021.

On December 21, 2018, the Board had elected Jeffrey F. O’Donnell as lead independent director of the Company for a term of one (1) year, commencing January 1, 2019, or until his replacement is elected. For his services as lead director until he resigned, Mr. O’Donnell received cash compensation of $12,000 per month in 2021 for five months in addition to the compensation paid to Mr. O’Donnell as a member of the Board.